Last Updated: August 9, 2025

- Table of Contents

- Summary (Quick Take)

- 1. Automotive Industry Demand (Primary Driver)

- 2. Supply Risks and Production Concentration

- 3. Market Speculation and Investment Flows

- 4. Substitutes and Price Competitiveness

- 5. Currency and Macroeconomic Factors

- Practical Checklist for Investors and Industry

- Frequently Asked Questions (FAQ)

- Conclusion

Table of Contents

- Summary (Quick Take)

- 1. Automotive Industry Demand

- 2. Supply Risks and Production Concentration

- 3. Market Speculation and Investment Flows

- 4. Substitutes and Price Competitiveness

- 5. Currency and Macroeconomic Factors

- Practical Checklist for Investors and Industry

- Frequently Asked Questions (FAQ)

- Conclusion

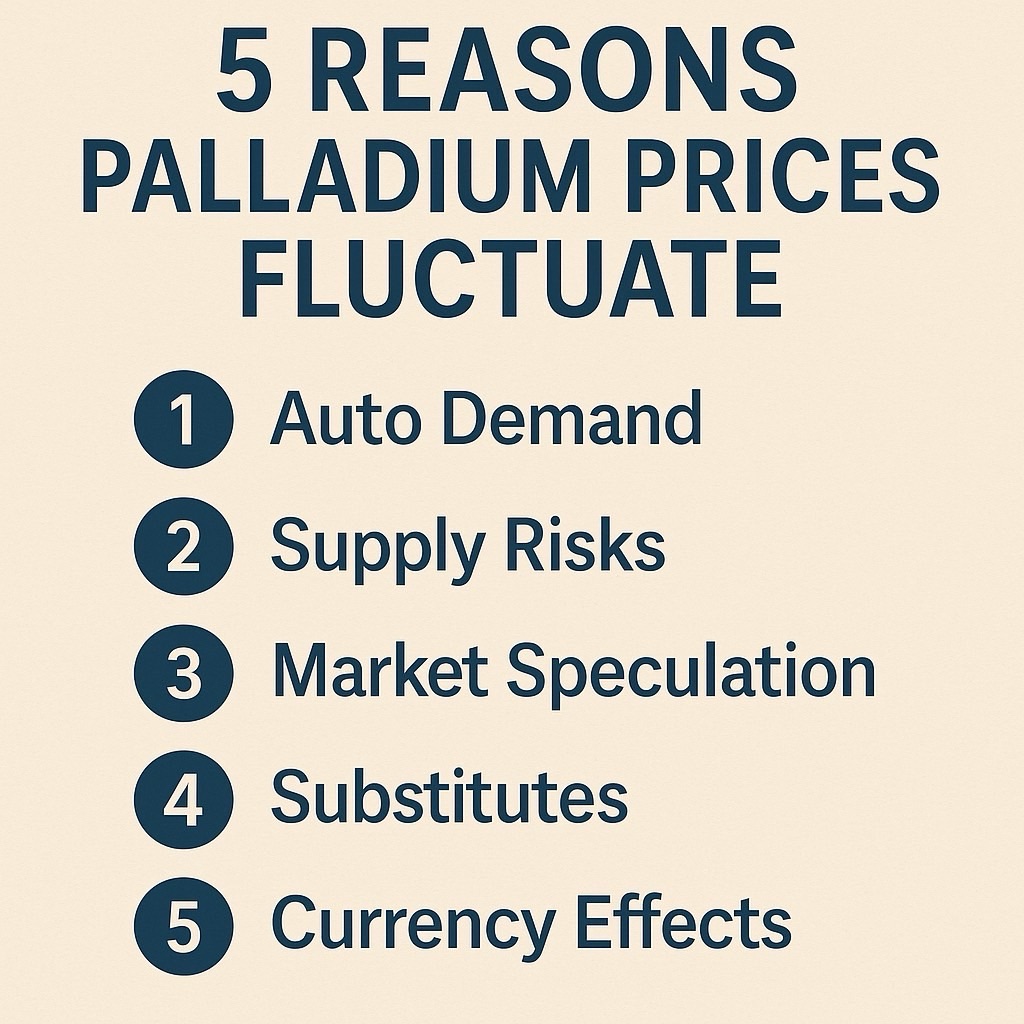

Summary (Quick Take)

Palladium price movements are primarily driven by real demand from the automotive sector and supply risks due to concentrated production. These are amplified by investment flows, substitute metal dynamics, and broader macroeconomic and currency factors.

In short: Auto demand + fragile supply + financial market influences shape both short-term volatility and long-term trends.

1. Automotive Industry Demand (Primary Driver)

The majority of palladium is used in catalytic converters for gasoline-powered vehicles, making the auto industry the biggest consumer of this precious metal.

- Global vehicle production directly impacts palladium demand.

- Tighter emissions regulations increase palladium loading per vehicle, pushing prices up.

- On the other hand, electric vehicle (EV) adoption reduces catalytic converter demand, weighing on prices in the long term.

2. Supply Risks and Production Concentration

Palladium production is heavily concentrated in just a few countries, making the supply chain vulnerable.

- Major producers are Russia and South Africa, together accounting for over 70% of global supply.

- Political instability, sanctions, labor strikes, or power outages can quickly disrupt production and cause price spikes.

- Recycling (from scrapped vehicles) supplements supply but cannot immediately offset major disruptions.

3. Market Speculation and Investment Flows

Like gold and platinum, palladium is traded as an investment asset. ETF inflows, futures positions, and hedge fund activity can amplify short-term price swings.

- Risk-off sentiment may divert capital to gold, reducing palladium demand.

- Conversely, supply shocks can attract speculative buying, pushing prices higher.

4. Substitutes and Price Competitiveness

When palladium prices soar, automakers may partially switch to platinum or rhodium in catalytic converters, limiting further price gains.

- Substitution depends on technical feasibility and market conditions.

- Complete replacement is rare due to performance and engineering constraints.

5. Currency and Macroeconomic Factors

Palladium is priced in U.S. dollars, so exchange rates, interest rates, and global growth trends all matter.

- Weaker USD: Makes palladium cheaper in other currencies, boosting demand.

- Economic downturns: Lower auto sales reduce palladium consumption, dragging prices down.

Practical Checklist for Investors and Industry

- Track global vehicle production forecasts and EV adoption rates.

- Monitor political and labor developments in key producer nations.

- Watch substitute metal prices and technologies.

- Follow ETF flows and futures positions for short-term sentiment.

- Keep an eye on USD trends and macroeconomic indicators.

Frequently Asked Questions (FAQ)

Q. Is palladium a better investment than platinum?

A. It depends on your risk tolerance. Palladium tends to be more volatile due to supply concentration. Diversifying across multiple precious metals can help balance risk.

Q. How will EV adoption affect palladium demand?

A. As EV adoption accelerates, long-term palladium demand for catalytic converters will decline. However, hybrids and gasoline vehicles will remain in use for years, softening the immediate impact.

Q. Can substitution happen quickly when prices spike?

A. Not usually. Switching to platinum or rhodium requires engineering changes and testing, which can take time.

Conclusion

Palladium prices are shaped by auto sector demand and supply fragility, with speculative flows, substitutes, and currency shifts adding extra volatility. While short-term price spikes are often supply-driven, long-term trends will hinge on EV adoption and advances in emission control technology.

コメント